Last Updated on August 14, 2023 by HBW2

Recently about 1 lakh employees have been laid off by different big tech, bank, car making companies. The tech giants Google has laid off about 12000, the Microsoft about 10000, the e-commerce giants Amazon about 18000, the social media platform Facebook and its parent companies META about 12000. The big banks like JP Morgan, Credit Suisse, Start-Ups have also laid off several employees to cut their expenses. The total laid off done by the companies up to January, 2023 is greater than that of the whole 2022. This is an initial sign of global recession.

What is recession?

A negative growth of Gross Domestic Product (GDP) or in word of economics if GDP declines two consecutive financial quarter is called recession.

Recession in respect of US Economy:

When discussing about global recession first thing comes in mind, the condition of American economy. Performance of US economy is one the major factors of global economy.

· At the time of COVID-19 Pandemic like other economy US economy is also facing a slow down due to less expenditure by public. Considering this situation the manufacturing companies have lessen their production. The US government has infused huge amount currency to the economy by excess printing of US dollar. But the manufacturing industry was unable to expand its production. This disrupted the demand & supply chain. So the inflation rate has risen gradually. The inflation touched at 9.1 % in January, 2022 which is highest from last 40 years. (Source: US Bureau of Labour Statistics).

· Tackling the high inflation the US Federal Reserve has increased the Fed Rates rapidly. The Fed Rate was 0.5 % in May, 2022, this rate has gone up to 4.75 % in Feb, 2023. The commercial banks have also increased their lending rates accordingly. Public as well as the corporate are unwilling take loans, as the interest rates are pretty high. The demand has decreased in the market. The manufacturing industries have reduced their production. Currently the Purchasing Manager’s Index (PMI) is 46.3 as on 31st March, 2023. It is assumed that when the PMI is below 50, economy is entering into a state of recession.

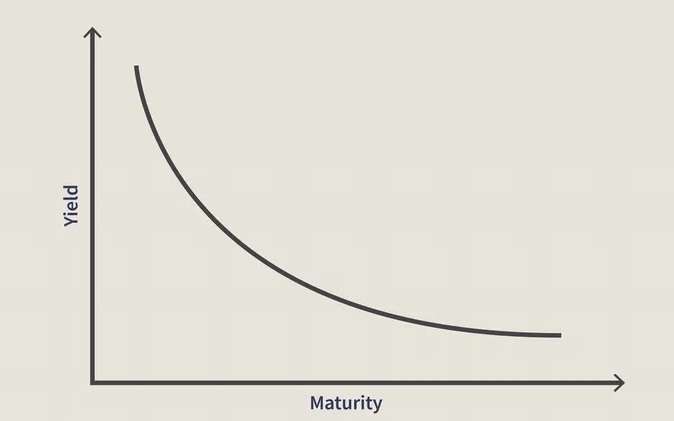

· Another very authentic indicator of upcoming recession is Bond Yield Curve. US bond yield curve reaches deepest inversion since 1981. It suggests that while investors expect interest rates to rise in the near term, they believe that higher borrowing costs will eventually hurt the economy, forcing the Fed to later ease monetary policy. It is a strong indicator that economy is going to state of recession. In recent past the IBYC found in 2006 and 1998 which have turned into recession in 2008 and 1998 respectively.

Inverted Bond Yield Curve

· The banking crisis in US economy is also aggravating the global economic slowdown. The bankruptcy of Silicon Valley Bank (SVB) has created a turmoil condition among the global Start Up eco-system and venture capitals.

· A survey has been conducted by KPMG, a multinational professional services network, regarding the upcoming recession among the 1325 CEOs of different big multinational companies. It is found that 86% of the CEOs are agreed on the upcoming recession. 80 % of them have replied that job cut will be a common strategy to manage the expenditure.

· The Russian-Ukraine war has disrupted the global supply chain of wheat and gas. The US and all the European Union countries are facing a trouble in arranging energy and different cereals. Some of the Asian countries like Srilanka, Pakistan has gone to a sheer poverty. People are fighting for food and continuous black out of several weeks are seen in recent times.

Recession in respect of Indian Economy:

India is the demographically 2nd largest country and 5th largest economy in the world. So the economic activity and financial stability are very much essential for the well being of life about 1.4 billion people. Although US economy is very much linked to the global economy, but the effect of recession may not show very much disturbances on Indian economy. There are some basic factors which have played a critical role in recession of Indian economy. The most internal factor of recession is demonetization policy. The policy of demonetization in 2016 has interrupted the growth of economy. The manufacturing process has seen a long unproductive miserable phase. The unemployment rate has risen at that period. In addition to that some other issues have also played a detrimental effect on economy.

· Out-break of COVID-19 Pandemic.

· Russia- Ukraine war

· Rising inflation.

The NDA led Central government has infused about 20 Lakhs crore in the economy phase wise by different ways. The after effect of this infusion a 15 % rise of GDP has been seen from the year 2020 to 2021 but at the same time inflation also has increased. The Reserve Bank of India has increased its repo rate from 4 % to 6.75 % on March, 2023 to curb down the high rate of inflation. The commercial banks have increased their rate of interest for public & corporate. As the supply of money is less the purchasing capacity of public is also declined. Likewise the manufacturing industry has lessened their production. Overall it affected the GDP of India. It is noticed that GDP has decreased in consecutive two quarter of FY 2022-23.

| Quarter | Duration | GDP |

| 1st Quarter | April-June | 13.5 % |

| 2nd Quarter | July-Sept | 6.3 % |

| 3rd Quarter | Sept- Dec | 4.4 % |

So this is an early indication of upcoming recession.

What should we do to handle this recession?

· For the corporate and business owner any type of expansion should be well analysed before investing.

· Savings capacity should be increased to handle any unforeseen incidents.

· Personal investments should be continued with reasonable amount of fund.